MEDICARE EXPLAINED

Explore the various plan options in your area.

We help streamline plan enrollment, so you get covered faster and easier

Understanding your Medicare options can be confusing and the choices you make will affect the quality of your care in many ways. That’s why Do It For Me Insurance Inc. guides you step-by-step through enrollment and evaluating and applying for supplemental plans and prescription drug coverage.

We also provide clear, straightforward advice on what type of policies may be suitable if you have existing or complex medical needs, including suggesting ways to use multiple policies to get more comprehensive coverage at the best possible cost.

Do It For Me Insurance Inc. provides trusted, local, fee-free service to help you make the right choices for your health.

To learn more about Do It For Me Insurance Inc., please read below. If you need immediate assistance please give us a call at:

1-267-374-0975

Key Advantages

Carrier choice and flexibility

What You Need to Know

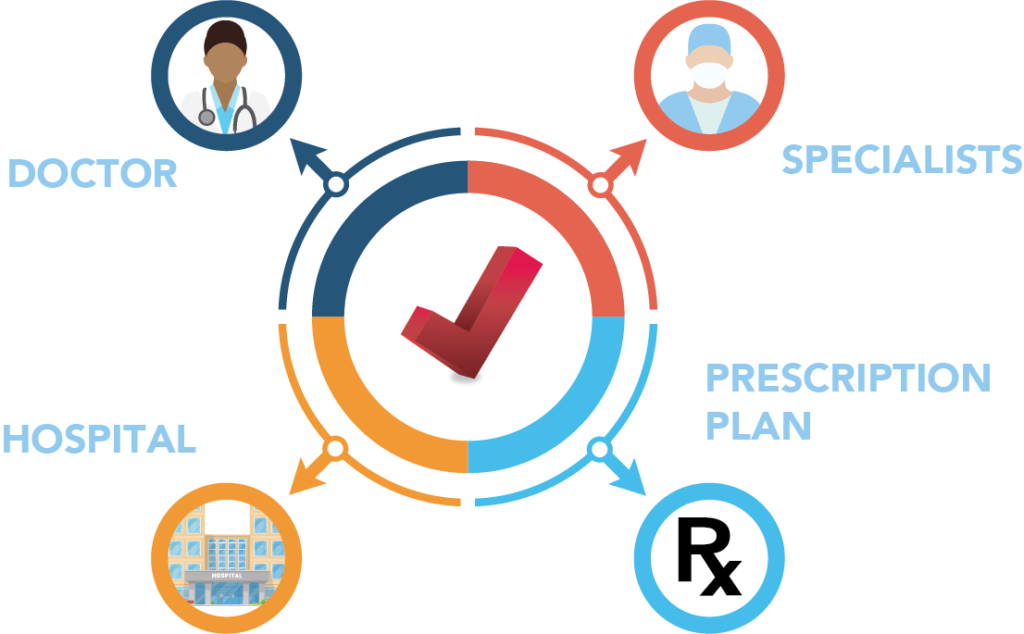

How Medicare Works

Medicare is a federal insurance program that provides health insurance for people 65 and older and individuals younger than 65 that may qualify due to a disability. There are four different parts to Medicare — Part A, B, C, and D. See below to learn more about each part!

Your Medicare Timetable

You can enroll in Medicare…

Part A

Any time after turning 64 years and 9 months old

Part B and Part D

(There is no longer a Part C for new enrollees.)

(Enrolling after this will incur penalties.)

Open Enrollment

You can change plans between October 15 and December 7

Medicare Supplement Insurance

Pays for potentially costly expenses like co-pays and deductibles that Medicare alone doesn’t cover

Medicare Parts A and B cover about 80% of healthcare costs. Medicare Supplement Plans (often called “Medigap” plans) cover the rest. Our representatives can help you choose and customize coverage that fits your life and health circumstances. Any provider that accepts Medicare will accept your supplemental insurance. You can enroll throughout the year, and you cannot be denied coverage, even if you encounter a serious health concern.

Do It For Me Insurance Inc. can help update your coverage to ensure you can still visit Your doctor— Your specialists—Your hospital

Medicare Advantage Plans

Gives you the benefits of Medicare hospital and medical insurance, and often prescription drug coverage, too.

Medicare Advantage Plans (called “Part C” plans) combine the coverages of Parts A and B, and often Part D, as well. Our team can help you decide if a Part C plan is right for you, find local providers, compare costs, and help you understand the pros and cons of providers that are health maintenance organizations (HMOs) and preferred provider organizations (PPOs). We can also help you select plans with prescription drug options that cover your medications.

10 Things to Know

1. You must continue to pay your Medicare Part B premium. When enrolling in a Medicare Advantage plan, Medicare then gives your premium to the Medicare Advantage plan to help pay for your additional coverage.

2. Medicare Advantage has you covered. Medicare Advantage plans must cover all the services that Original Medicare covers and many offer additional benefits. Important: Hospice care is still covered under Original Medicare.

3. Joining a Medicare Advantage plan may affect your current coverage. If you have existing coverage or employer‑provided health insurance and plan to work past 65, check to see how joining a Medicare Advantage plan could affect or cancel your current coverage.

4.It’s best to use network providers. Use of network health care and pharmacy providers is typically required. Using providers outside of the network may cost you more or not be covered at all. In an emergency, you can use any provider.

5. You may qualify for financial assistance. Depending on your financial situation, you may qualify for help paying your plan premiums or Part D medications through a low income subsidy or Extra Help.

6. If you enroll in Part D late, you may pay a penalty. This is an additional amount charged by Medicare that will be added to your Part D premium if you go without Part D coverage for longer than 63 days in a row after your Initial Enrollment Period. Medicare Advantage plans that include Part D coverage meet Medicare coverage requirements.

7. A Medicare supplement insurance plan (Medigap policy) is not a Medicare Advantage plan. Medicare supplement plans are private health insurance policies and are secondary to Original Medicare. Medicare Advantage plans combine Original Medicare Parts A and B, and often Part D, into a single plan.

8. Keep your Medicare Advantage member ID card handy. Members must present their member ID card, not their Original Medicare card, when receiving services.

9. Medicare Advantage offers the same protections as Original Medicare. Even though Medicare Advantage plans are privately administered, you still have the same rights and protections as with Original Medicare.

10. You have a built-in financial safety net. All Medicare Advantage plans have an annual out‑of‑pocket maximum, that ensures you’ll never pay more than a certain amount out of pocket in a given plan year for covered medical services.

Medicare Advantage Plans

MEDICARE PART A

Inpatient and hospital insurance

Skilled nursing care

Hospice care

Some home health care

MEDICARE PART B

Outpatient medical insurance

Outpatient care

Durable medical equipment

Preventative services

MEDICARE PART C

Medicare Part C (Medicare Advantage) are privately managed, federally approved Medicare plans. Part C plans combine the benefits of Part A and B into one plan and may also include:

Outpatient medical insurance

Prescription drug coverage

Dental, vision, and hearing coverage

Wellness programs and telehealth

MEDICARE PART D

Medicare Part D plans provide beneficiaries with privately managed, federally approved prescription drug coverage. Medicare Part A and B don’t offer prescription drug coverage, so Part D helps:

Often provides discounts in-network

Taking the Next Step

Need help exploring plan options?

Enter your information below and a licensed advisor will contact you.

Do It For Me Insurance Medicare

"*" indicates required fields