5 Days Left to Enroll or Change Health Insurance for 2022 – Common Challenges Encountered!

The FINAL Deadline for 2022 Health Insurance coverage is this Saturday, January 15, 2022 (Jan 31st in New Jersey)!

Enrolling in your plan is only half the journey, in order to “effectuate” the coverage you must pay the first binder payment before the coverage is active. It is also crucial to pay attention to any notices requesting documentation.

We are available to help you with post-enrollment documentation, updating income estimates, understanding your network, specific benefits based on your needs, trouble-shooting the binder payment process, and any carrier-related issues.

Income, age and household size-based subsidies, although not as high as they were in 2021, continue to remain at a comparatively all-time high due to The American Rescue Plan Act. We can help you connect if you still haven’t, or offer a FREE no obligation second opinion.

If we connected regarding 2022 coverage, this information can serve as a review. You can make changes to coverage up to the SATURDAY’s deadline (Jan 15 for most of the country and Jan 31st in NJ and a few other states).

If you are looking for a fast quote, click here!

Plan year 2021 and the 2022 Open Enrollment are unique mainly due to The American Rescue Plan, which passed back in March of 2021. Although there have been drastic price changes for many, especially those who were eligible for unemployment in 2021, more people are still qualifying for assistance whereas in years past their income was deemed to be too high.

As open enrollment 2022 comes to a close, we felt it suitable to discuss some of the challenges we have seen, and offer our expertise to help you make an informed decision as to which coverage is right for your particular situation!

Challenge #1: Those who were eligible for at least one week of unemployment in 2021, regardless of income level, had access to Silver plans with full “Cost Sharing Reductions.” The 2021 “unemployment” eligibility allowed consumers to have enhanced plan benefits usually only available at lower income levels. This enhanced assistance expired on 12/31/2021. We are happy to examine your plan with you to make sure you understand the changes to price and benefits for 2022 before the deadline of January 15th 2022.

Challenge #2: For some, we found there to be discrepancies between what the Health Insurance Marketplace/Exchange (Healthcare.gov and State Exchanges) projected their 2022 premium to be and what the mailed direct-from-carrier notices stated. Often these direct-from-carrier notices did not arrive until after the December 15th cutoff for January 1st 2022 coverage passed, leaving some with an unanticipated increase once the official bill arrived. There is still time to change for February 1st: text Joe at 267-374-0975 or Robyn at 267-885-8823.

Challenge #3: Enrollment fatigue was a factor since many new consumers found their way to Health Insurance Marketplace/Exchanges throughout 2021, with the expanded open enrollment time periods, benefits, and subsidies. These consumers didn’t realize re-enrollment was necessary for 2022, in response to plan and subsidy changes, as they enrolled for 2021 only a few months prior! You still have until January 15th to enroll in coverage to start February 1, 2022.

Challenge #4: New carriers and options in a market encourages competition and helps stabilize the overall risk pool for that particular market. However, not all options are equal. ALWAYS CHECK YOUR DOCTORS or have us check them for you to make sure they are in the plan’s network, and identify provider Tier within Tiered Networks. Don’t rely on provider and drug finders through third parties or even the Exchanges. Go directly to the insurance carrier to search your doctors/providers/drugs. You can call the doctor’s office to ask, but with the constant changing of insurance networks, billing departments are not always up to date on which plans are being accepted. For example, the new Cigna plans found in the Philadelphia 5-County Region do not use the same Cigna network that many have had in the past through a former employer. In this example, if you call your doctor and ask, “Do you take Cigna?” and they say “Yes”, it may or may not apply to your particular Cigna plan.

Challenge #5: Prescription costs continue to be a driving factor. When it comes to options available on the Individual Market (non-employer-sponsored group), most plans present challenges in the prescription department. It does not always make sense to pay for a more expensive-premium plan to have a lower prescription copay. We always recommend, even for our Medicare clients, to explore alternative options such as utilizing GoodRx, asking your doctor for substitutes, and contacting the drug’s manufacturer to see if assistance is available. Some manufacturers have coupons on their websites. Don’t assume that you won’t qualify, it can not hurt to try!

Challenge #6: After you enroll in a plan, you may be asked for supporting documentation, such as proof of income or proof of citizenship. For PA, NJ, MD, and most other states, if you are our client we can help you interpret your notices to reassure that your account is in good standing with the Marketplace/Exchange. This open enrollment has been particularly challenging with documentation for PA and NJ, but we are here to help you work through it. In most cases you have ample time to supply documentation, but don’t ignore. We understand that you are blasted with emails and notices that are confusing. The most important notices are the ones asking for documentation, they should not be ignored, and can result in losing your subsidy or coverage if not addressed on time!

Challenge #7: In PA and NJ whenever a plan was changed, a notice was e-mailed and mailed out stating that the consumer was “dis-enrolled” from prior coverage with no mention of the “re-enrollment” into a different plan, completed immediately afterwards. This was an extreme way of letting the consumer know about a plan change. In most cases, the 2022 plan change occurred without issue and the consumer was successfully enrolled.

If you are a current client, the remainder of this email is a repeat of information we sent earlier.

Pennie and GetCoveredNJ made the process easier for us to coordinate with clients, or those who would like to become clients (no fees or price increases for year-round service). With a few clicks you can add us to your Pennie.com, GetCovered.NJ.gov, MarylandHealthConnection.gov, and Healthcare.gov accounts.

After enrollment, look out for communications from Pennie/GetCoveredNJ (or other exchange for non PA clients) in case they request additional information – we can help if you alert us. Text us to let us know if you receive a Pennie letter you need help with. No need to send the letter, just give us the date at the top, and we can let you know how to proceed.

If you have a friend or loved one who needs help, feel free to pass along our contact information! Our consultations can be done over the phone, zoom or video conferencing platform of your choice. The fastest way to get in touch with us is via text (267-374-0975) or email!

For our Clients who have Medicare, our brand-new Medicare webpage is full of valuable information as well as self-service quoting tools (you call us, we won’t call you unless you want us to), presented in an easy-to-follow format. Here’s the short cut: https://www.doitformemedicare.

For our Clients who are in need of Health Insurance, help with Pennie, GetcoveredNJ, MarylandHealthConnection, or Healthcare.gov, we sought to create a unique Health Insurance shopping and renewing experience. Check out our “Fee Free Help” options for more guidance!

This time of year can get hectic, but we are here to help. To organize phone appointments this year we are using the services of Calendly. You can select a time to have a phone or virtual consultation with Joe to discuss your 2022 options for Health Insurance.

Pennie Open Enrollment is November 1st to January 15th!

GetCoveredNJ’s Open Enrollment is November 1st to January 31st

Maryland Health Connection and Healthcare.gov’s Open Enrollment is November 1st to January 15th!

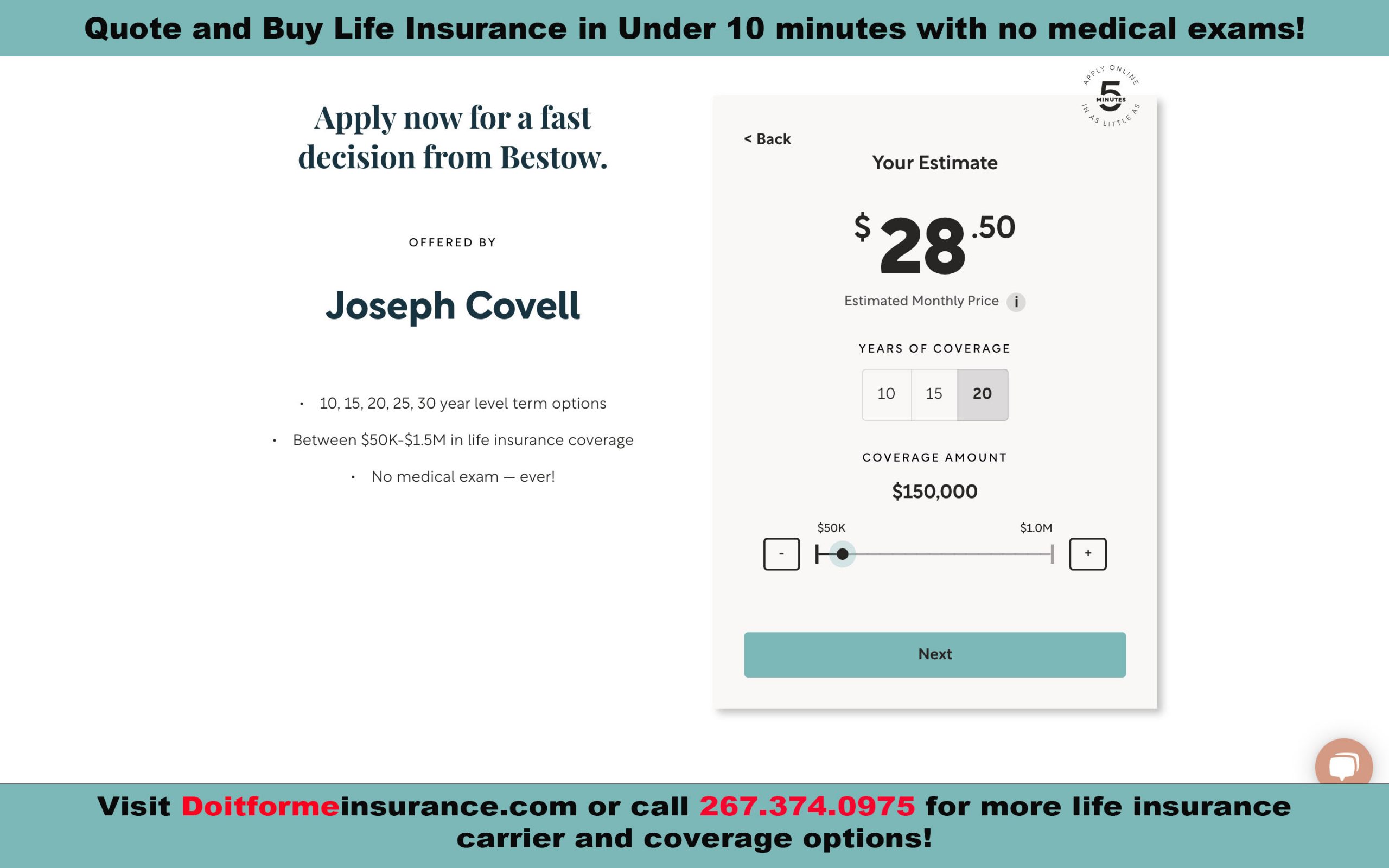

Do It For Me Insurance offers Life Insurance options through dozens of companies. Here is only one of our many options. The company is Bestow (owned by North American) — they have a streamlined approach to quoting and enrolling in Life Insurance, without a medical exam/nurse visit to your home.

If you are healthy but sick of paying for stacked plans that include services you never use, we are here to help you decide if a less-expensive option serves your needs.

Please be careful of the junk “health plans” being sold by mass-telemarketers, cleverly disguised as health insurance. Read the fine print. “Health Plans” are NOT INSURANCE and will not catch you if you fall. Protect your income and assets with insurance which includes a STOP LOSS.

The maximum length of Short Term Medical in PA remains approx. 12 months (360 Days). Click here to quote and enroll!

Short Term Medical requires that you answer medical questions, but this is the only “Obamacare alternative” that protects your income and assets with an out of pocket maximum or “stop loss”. Pair it with UHC’s Health Protector Guard for a more comprehensive plan! Quote UHC Options Now (I recommend a higher deductible Short Term with a Health Protector Guard option that fits your budget).

We still have health insurance available through a few local and national associations, so for those not eligible for the subsidy and in good health – there are more options!

During this busy time of year we will make every effort to return your call within 24 hours! Joe checks his e-mail around the clock, and you may get a quicker response if you email him at:

[email protected] or text 267-374-0975.

DoitForMeInsurance and Joe Covell also handles your Dental, Vision, Life, Home, Auto, Group Health, and Business Insurance Needs! Shop everything on our website!

Contact us today to explore all your insurance options, or to book your phone/zoom appointment. Enrollments can be done over the phone, e-mail, text, or if you prefer to do on your own, you can select “Jospeh Covell” (National Producer Number 16623825) as your broker on Pennie.com, Getcovered.nj.gov, marylandhealthconnection.gov, or by inputting his NPN on Healthcare.gov, so we can assist you year-round. Office appointments are available upon request. Our office is COVID-19 complaint with all CDC safety precautions. We are a certified Independence Blue Cross #SafeEnrollmentSpace for both the Over and Under-65 communities! Please email [email protected]

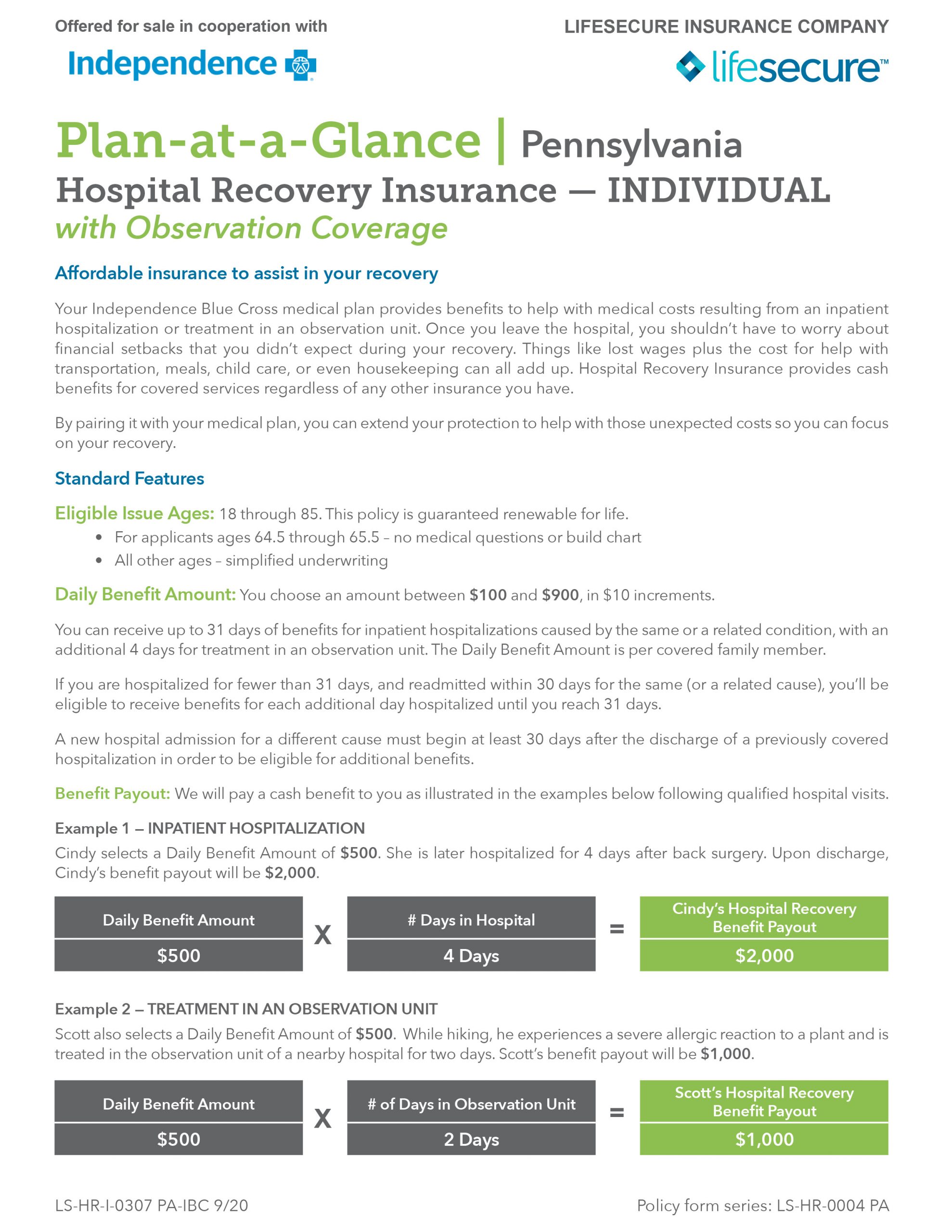

Independence Blue Cross (Philadelphia, PA Region) recommends an accident, critical illness, or hospital plan to expand your coverage. These are plans that PAY YOU directly (or the provider) when unforeseen events occur, similar to Aflac (we offer them too) but endorsed by Independence Blue Cross. For example, it would help with lost wages while out of work. These plans are offered through Lifesecure and are available in most states. Click our easy to use link for more details and pricing

Warning: This is NOT HEALTH INSURANCE, it is an indemnity plan meant to fill gaps that currently exist within health insurance.

We are certified for: Pennie.com (PA), GetCoveredNJ (NJ), Maryland Health Connection (MD), and many Healthcare.gov states. If you currently have an account and want to designate us as your broker (if we aren’t already tied to you), here is how you can do so, at no cost to you what so ever!

Joe and Robyn are sincerely grateful for your continued support of our small business.

Joseph L. Covell

PA, NJ, DE, MD, FL, MI, GA, SC, VA, OH, TX, and most other states Licensed Health, Life, Disability, Property, and Casualty Insurance Broker

Custom Benefit Plans, Inc.

Source Insurance Group

www.doitformeinsurance.com (

Cell: 267-374-0975

Fax: 215-830-0908 (attention: Joe Covell)

E-mail: josephlcovell@gmail.

Robyn Barto

Licensed Health and Life Insurance Broker

www.doitformeinsurance.com

Cell: 267-885-8823 (no voicemail, text a message)

Fax: 215-830-0908 (attention: Robyn Barto)