Comparing Medicare Supplement Plans: Plan G vs Plan N

Medicare Supplement Plans, also known as Medigap, are private health insurance plans designed to address the gaps in coverage provided by Medicare. These plans offer financial predictability by covering copays, coinsurance, and deductibles that Original (Traditional) Medicare does not fully cover. Among the popular options are Plan G and Plan N, which provide comprehensive coverage for Medicare beneficiaries. There are distinct differences between the two. In general, Original Medicare leaves individuals with a potential 20% financial liability for their medical bills, without any cap, i.e. out-of-pocket maximum (OOP) or maximum out-of-pocket (MOOP), when not supplemented by a Medigap Policy or even a Medicare Advantage Plan.

Plan G – The Crème de la Crème

Plan G is the most comprehensive Medigap plan that one can purchase. It provides coverage for all copays, coinsurance, and deductibles, with one exception – it does not cover the Part B deductible. Plan G also covers excess charges, which are additional fees that healthcare providers may charge beyond the Medicare-approved amount. Simply put, you pay the first $240 (The Part B Deductible for 2024, subject to annual changes.) to the first provider you see each year, and the plan covers all other Medicare-covered expenses for that calendar year.

Plan N – The Savvy Consumer’s Choice

Plan N is a balanced option, bridging the gap between comprehensive Medicare Supplement Plans and Medicare Advantage Plans. It offers manageable copays for certain services and predictable coverage for unexpected medical expenses. For example, imagine encountering expensive durable medical equipment that exceeds the annual Maximum Out-of-Pocket (MOOP) limit of a Medicare Advantage Plan. With Plan N, copays for doctors and specialists are capped at $20 (and can be even lower depending on the physician). Please note that with Plan N, Medicare excess charges are typically not covered (certain states prohibit it). Individuals enrolled in Plan N are responsible for the difference between the Medicare-approved amount and the actual charge. These charges, which can be as high as 15% where applicable, may vary by state. For comprehensive information, please visit Medicare.gov. Understanding the nuances of Medicare Supplement Plans is crucial in making well-informed decisions about healthcare coverage.

Key Points to Remember

By considering the differences between Plan G and Plan N, individuals can select a plan that best suits their needs, providing financial security and peace of mind in the face of medical expenses. It’s important to remember that Medicare mandates the coverage requirements for Supplements, which must be consistent across all insurance companies. Each Lettered Plan (Plan G, Plan N, etc.) offers identical coverage across carriers. Companies can elect to add extra benefits, value-adds, and discounts at their discretion, enhancing the options available to customers. These add-ons should not be expected and are not the norm with most Medicare Supplement Companies in the current environment.

At Do It for Me Insurance, we believe that Medicare Supplements provide the most comprehensive coverage available, with Plan G being the top choice for most individuals (except those eligible for Plan F, although the cost difference usually makes Plan G a more sensible option). Plan N is also worth considering, but everyone’s needs and budget may vary. If a Supplement is unaffordable or not necessary for you, Medicare Advantage Plans are an alternative that continues to gain popularity, especially as supplement prices increase over time.

Do Medicare Plans Provide Coverage for Part D Prescription Benefits?

It’s important to note that Medicare Supplements do not include Medicare Compliant Part D Prescription Coverage. For that, you will need a separate Prescription Drug Plan (PDP) or an equivalent qualified coverage such as Social Security’s Extra Help/Low Income Subsidy (LIS), a state pharmaceutical program, VA (Veterans) benefits, etc. The Medicare deductibles are set annually and reset for everyone, regardless of when signing up for a plan, on the 1st of January each year.

“Non-Network” and Medicare Reimbursement

Medicare Supplement plans, including Plan G and Plan N, are considered “non-network” or “no-network”plans. This means that you have the flexibility to visit any doctor or healthcare provider who accepts Original/Traditional Medicare. No matter which Medicare Supplement insurance carrier you select, as long as Medicare provides coverage for a particular service, the supplement will also cover it, unless otherwise specified. Some Medigap carriers provide additional benefits such as GYM Memberships and Dental Discounts (again not a common practice). Medicare Supplements are designed to focus on medical coverage rather than “extra benefits” promoted by celebrity personalities advertising the advantages of Medicare Advantage Plans.

Most doctors in the United States prefer dealing with Original Medicare and Supplements because it allows them to bill the two different entities without much difficulty. Contrast that to Medicare Advantage plans, where providers usually need to participate in the network (HMO, PPO) or agree to the terms of the plan’s network, such as in a Private Fee For Service or other Cost Plan models.

Medicare Advantage Plans come with the “gatekeepers” associated with most managed care-type models, where the doctor is paid a predetermined amount (usually paid monthly by the carrier regardless of how many times you see the provider that year). This amount can vary significantly for independently owned doctors compared to those owned by large health systems. In an institutional-based Medicare Advantage Plan, the institution can be paid a considerably higher amount but also shares in the cost when the member is hospitalized.

Excess Charges

To delve deeper into Excess Charges, they refer to additional fees that certain doctors may impose beyond the Medicare-approved amount. It’s crucial to note that not all doctors charge excess charges, and the maximum amount usually cannot exceed 15%, although this can vary in some states. Currently, states such as Pennsylvania, Connecticut, New York, Massachusetts, Minnesota, Ohio, Rhode Island, and Vermont have laws prohibiting doctors from charging excessive fees. It is important to always keep in mind that state and federal laws can change. If these states were to modify their laws, the implementation of a guarantee issue period would be a hopeful possibility. This would allow individuals with Plan N (or a similar plan that doesn’t cover excess charges) to switch plans or carriers without undergoing medical underwriting or answering health questions..

It is crucial to understand that Medicare excess charges happen when doctors charge more than the scheduled reimbursement amount set by the Centers for Medicare and Medicaid Services (CMS). While Plan G covers these costs, Plan N and other options do not. When selecting a plan, it is essential to carefully consider the coverage options and potential out-of-pocket expenses.

It’s important to highlight that the majority of doctors, approximately 98%, accept Medicare reimbursement and do not feel the need to charge excess charges.

Plan Stability

Plan G has emerged as the preferred option for new Medicare enrollees, while Plan F is being phased out for new beneficiaries. The increasing number of individuals choosing Plan G will inevitably affect its future rates. In contrast, Plan N, being chosen by more cost-conscious consumers, may offer greater rate stability in the long term. These statements are based on the general risk-pools of each plan, taking into account the claim history of currently enrolled individuals. It’s important to note that experiences may vary depending on the carrier and the region. Keep in mind that this can differ based on different factors.

Since Plan G remains the more popular choice and many individuals are compelled to select it, Plan N could offer a better safeguard against yearly increases. It tends to attract health-conscious or more informed consumers who recognize that, in numerous instances, the average cost difference between Plan G and N can be substantial. To put it simply, you might need to visit one to two doctors or the emergency room every month in order to not save money when comparing the typical cost disparities between the two.

How To Change Medicare Supplement Coverage

In most states, shifting between Medicare Supplement plans—even within the same insurance company—is not a straightforward process. It often necessitates completing a new application and undergoing medical underwriting, which may include health questionnaires and phone interviews with the insurance company to which you are applying. This thorough screening is designed to assess the risk you pose to the insurer, based on your health status and medical history. This can typically be done throughout the year in most states.

It’s important to note that the Annual Enrollment Period, Open Enrollment Period, and many Special Enrollments do not apply to Medicare Supplement Coverage. Some states, like New York, permit year-round open enrollment into Medicare Supplement Plans. Other states, such as Oklahoma with its new legislation, provide the opportunity to switch to another carrier during a specific window around your birth day each year.

What Does “Guaranteed Issue” Mean?

There are specific circumstances, known as Guaranteed Issue Rights, where you are allowed to change your Medicare Supplement Plan without going through medical underwriting. For instance, if you move out of your Medicare Advantage Plan’s service area, or if your current carrier terminates your coverage (not due to non-payment of premium), you have the right to choose a new plan without having to answer health questions. Another instance where this guaranteed issue applies is when you move to a location where your current insurer does not provide coverage (this situation can be rare since most companies are typically nationwide and likely to have a presence in the area where you are moving, although not always).

The most common example of Guaranteed-Issue is when you are currently enrolled in Part B of Medicare and are leaving your employer’s coverage. In most cases, you will be required to enroll in Plan F if you were eligible for Medicare before 1/1/20, or Plan G if you were eligible for Medicare after 1/1/20. Some states and carriers may allow for different plan options, but this should not be the general expectation. If you are leaving your employer coverage and do not have Part B, you have 8 months to enroll in it without penalty and can typically choose any plan since you’ll be considered “New to Part B.” We do not charge fees and are happy to help you evaluate whether you should delay or enroll in Part B if you are currently enrolled in employer coverage or being offered a retirement plan option through your employer or union.

As a reminder, you can apply for whatever plan you are eligible for at any time of the year, as long as you are willing to go through medical underwriting to see if you qualify!

Clarification of Plan F

Starting from January 1, 2020, there have been changes to Medicare coverage. Newcomers to Medicare are no longer eligible to purchase Plan F or Plan C, which previously covered the Medicare Part B deductible. Individuals enrolled in Medicare before this date can switch to another carrier’s Plan F if they meet the medical underwriting requirements in applicable situations and states. The same holds true for other grandfathered letters (Plan J for examply), provided that carriers continue to offer those plan options.

If you are healthy enough, you might consider migrating away from Plan F while it is still an option. With a limited number of new members eligible to change or purchase a Plan F Policy, the overall risk pool will continue to age and become less healthy, potentially affecting prices (purely speculative). On the other hand, the Part B deductible typically increases annually and may experience significant inflation, especially if a “Medicare For All” model is implemented in the US. We are here to assist you in comparing and contrasting all your options.

Selecting The Right Insurance Carrier

Selecting the right insurance carrier is of utmost importance and requires thorough consideration. While it may not always be easy to switch Medicare Supplement coverage, it is crucial to devote time to choosing the right carrier. With new carriers entering the market every day, the wide range of options can be overwhelming. In the Philadelphia Market, we often refer to a common example involving a well-respected A+ rated carrier. Despite having competitive rates (some years taking decreases), this carrier suddenly stopped accepting new policyholders. The ideal situation for their policyholders would be if they canceled existing policies, allowing those members a guaranteed issue to enroll with another carrier without being subjected to medical underwriting. While some individuals have been able to switch carriers, others have found themselves in a situation where they cannot move and do not wish to enroll in a Medicare Advantage plan.

The purpose of highlighting this example is not to shame any specific carrier, hence they will remain unnamed. Instead, it is to emphasize that when selecting a company, you can only do your best. For this reason, we direct consumers to a select few reputable companies with extensive experience in the Medicare Supplement Market. Typically, larger national companies with millions of members tend to have more stable rates due to their ability to distribute risks across a larger pool. We do not have any favorites when it comes to carriers, our intention is only to find the best fit for our clients. Our focus is on companies with excellent reputations and decades of experience. When providing quotes, we present five options for each plan and discuss the pros and cons of each company. While we consider the timing of past rate increases to gauge future increases, it is important to note that we are not underwriters and do not have access to a particular company’s current year experience, which could impact future rates.

Understanding Household Discounts

Within the Medicare Supplement market, there is much confusion surrounding household discounts. At our desks, we actually have a cheat sheet for the varying discounts offered by different companies. Traditionally, one was only eligible for a household discount if both you and your spouse were enrolled in a Medicare Supplement with the same company. However, this is no longer the case as many companies now offer different levels of household and other discounts, such as Electronic Funds Transfer (EFT) discounts, among others.

What do we mean by different levels? With certain companies, you may be eligible for a 10% discount simply by having a spouse, and a 15% (or higher) discount if both of you are enrolled with the same carrier. Some companies are more flexible and will provide the discount as long as someone over the age of 18 lives in the same household, including an adult child still residing with the policyholder.

To make it even more complicated, many national carriers have multiple companies within a specific region, and the discounts are constantly changing. Let’s look at the top five insurers like Cigna, Aetna, and Humana. In Pennsylvania, there are currently three different companies owned by Cigna. Those who purchased a Cigna policy 10 years ago are insured with a different company than those currently looking to buy the lowest-cost Cigna plan today, which can further complicate discounts.

If you bought the Cigna plan 10 years ago and now your spouse is enrolling in Cigna, your spouse will get the current discount being advertised, while you, on the other hand, will usually get the discount that was in force at the time you purchased your policy. Your policy may only have a 7% discount applied when your spouse enrolls, whereas your spouse may get the new 15% or even 20% (varies by carrier) discount available on the policy they are purchasing, even though it’s all the same parent company!

Household discounts are very important to consider when pricing out Medicare Supplement Policies.

Conclusion

Choosing between Plan G and Plan N depends on personal preference, health status, and financial situation. It’s crucial to consult with a licensed insurance professional to fully understand the benefits and coverage offered by each plan. Do It For Me Insurance is dedicated to addressing your inquiries about Medicare Plans and assisting you in finding the perfect match. Trust us to provide the guidance and support you need! Our new AI assistant is available 24/7 in the bottom right corner to promptly answer those common questions!

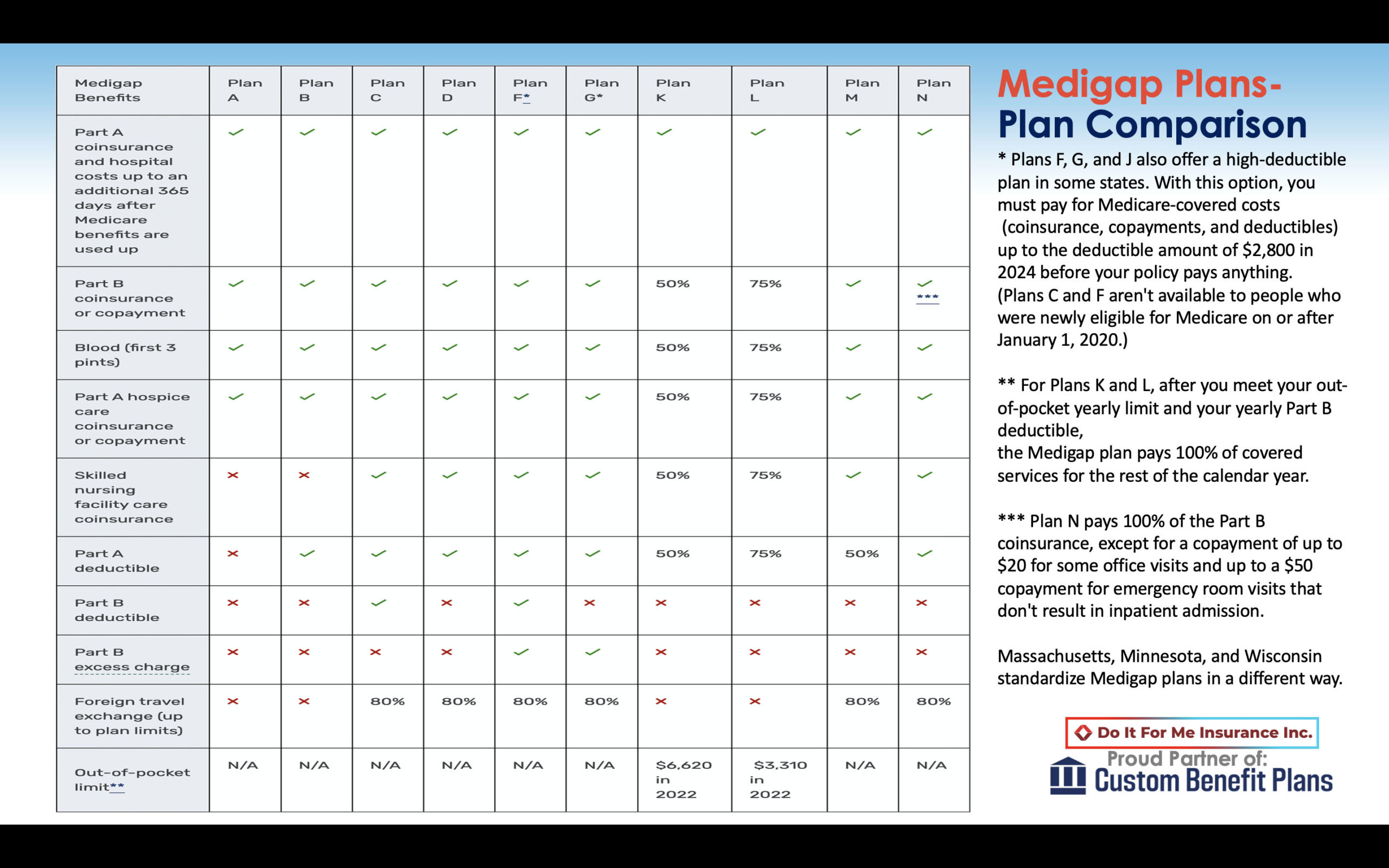

Standardized chart below for Medicare Supplements, as regulated by Medicare.

Credible References:

Medicare.gov. (2021). Medigap Plan G. Retrieved from https://www.medicare.gov/supplements-other-insurance/whats-medicare-supplement-insurance-medigap/medigap-plan-g

Medicare.gov. (2021). Medigap Plan N. Retrieved from https://www.medicare.gov/supplements-other-insurance/whats-medicare-supplement-insurance-medigap/medigap-plan-n

AARP. (2020). Changes Coming to Medicare Supplement Insurance. Retrieved from https://www.aarp.org/health/medicare-insurance/info-2019/changes-to-medicare-supplement-insurance.html